Venture Capital Financing

What is Venture Capital?

It is a private or institutional investment made into early-stage / start-up companies (new ventures). As defined, ventures involve risk (having uncertain outcome) in the expectation of a sizable gain. Venture Capital is money invested in businesses that are small; or exist only as an initiative, but have huge potential to grow. The people who invest this money are called venture capitalists (VCs). The venture capital investment is made when a venture capitalist buys shares of such a company and becomes a financial partner in the business.

Venture Capital investment is also referred to as risk capital or patient risk capital, as it includes the risk of losing the money if the venture doesn’t succeed and takes a medium to long term period for the investments to fructify.

Venture Capital typically comes from institutional investors and high net worth individuals and is pooled together by dedicated investment firms.

It is the money provided by an outside investor to finance a new, growing, or troubled business. The venture capitalist provides the funding knowing that there’s a significant risk associated with the company’s future profits and cash flow. Capital is invested in exchange for an equity stake in the business rather than given as a loan.

Venture Capital is the most suitable option for funding a costly capital source for companies and most for businesses having large up-front capital requirements which have no other cheap alternatives. Software and other intellectual property are generally the most common cases whose value is unproven. That is why; Venture capital funding is most widespread in the fast-growing technology and biotechnology fields.

Features of Venture Capital investments

-

- High Risk

- Lack of Liquidity

- Long term horizon

- Equity participation and capital gains

- Venture capital investments are made in innovative projects

- Suppliers of venture capital participate in the management of the company

Methods of Venture capital financing

-

- Equity

- participating debentures

- conditional loan

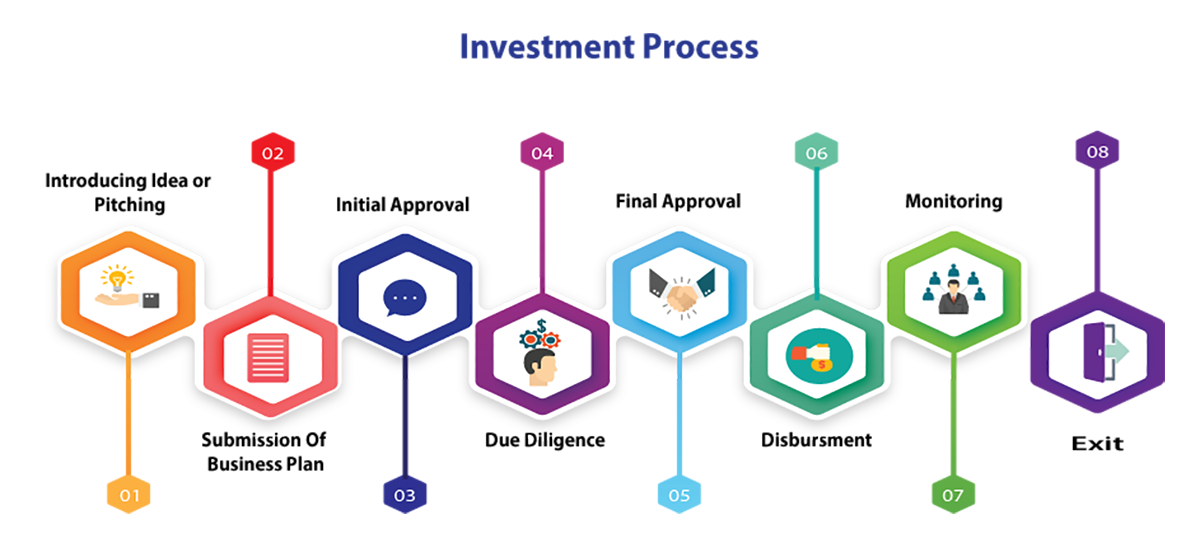

Approaching a Venture Capital for funding as a Company as follows:

Step 1: Idea generation and submission of the Business Plan

The initial step in approaching a Venture Capital is to submit a business plan. The plan should include the below points:

-

- There should be an executive summary of the business proposal

- Description of the opportunity and the market potential and size

- Review on the existing and expected competitive scenario

- Detailed financial projections

- Details of the management of the company

There is detailed analysis done of the submitted plan, by the Venture Capital to decide whether to take up the project or no.

Step 2: Introductory Meeting

Once the preliminary study is done by the VC and they find the project as per their preferences, there is a one-to-one meeting that is called for discussing the project in detail. After the meeting the VC finally decides whether or not to move forward to the due diligence stage of the process.

Step 3 : Evaluation:

After a proposal has passed the preliminary screening, a detailed evaluation of the proposal takes place. A detailed study of the project profile, track record of the entrepreneur, market potential, technological feasibility, future turnover, profitability, etc. is undertaken.

Venture capitalists factor in the entrepreneur’s background, especially in terms of integrity, long-term vision, urge to grow managerial skills and business orientation. They also consider the entrepreneur’s entre-preneurital skills, technical competence, manufacturing and marketing abilities and experience. Further, the project’s viability in terms of product, market and technology is examined.

Besides, venture capitalists undertake thorough risk analysis of the proposal to ascertain product risk, market risk, technological and entrepreneurial risk. After considering in detail various aspects of the proposal, venture capitalist takes a final decision in terms of risk return spectrum.

Step 4: Due Diligence

The due diligence phase varies depending upon the nature of the business proposal. This process involves solving queries related to customer references, product and business strategy evaluations, management interviews, and other such exchanges of information during this time period.

Step 5: Term Sheets and Funding:

If the due diligence phase is satisfactory, the VC offers a term sheet, which is a non-binding document explaining the basic terms and conditions of the investment agreement. The term sheet is generally negotiable and must be agreed upon by all parties, after which on completion of legal documents and legal due diligence, funds are made available.

Step 6: Post Investment Activity:

Once the deal is financed and the venture begins working, the venture capitalist associates himself with the enterprise as a partner and collaborator in order to ensure that the enterprise is operating as per the plan.

The venture capitalists participation in the enterprise is generally through a representation in the Board of Directors or informal influence in improving the quality of marketing, finance and other managerial functions. Generally, the venture capitalist does not meddle in the day-to-day working of the enterprise, it intervenes when a financial or managerial crisis takes place.

Step 7: Exit Plan:

The last stage of venture capital financing is the exit to realise the investment so as to make a profit/minimize losses. The venture capitalist should make an exit plan, determining precise timing of exit that would depend on a myriad of factors, such as the nature of the venture, the extent and type of financial stake, the state of actual and potential competition, market conditions, etc. Also, There are various exit options for Venture Capital to cash out their investment:

-

- IPO/Stock Market

- Promoter buyback

- Mergers and Acquisitions

- Sale to other strategic investor